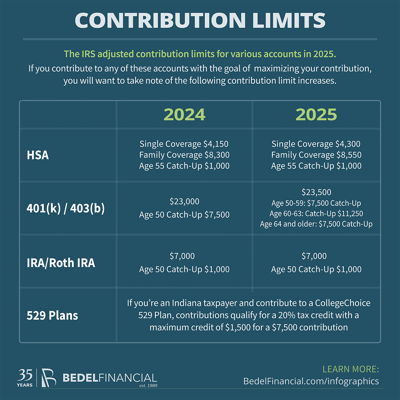

The IRS adjusted contribution limits for various accounts in 2025. If you contribute to any of these accounts with the goal of maximizing your contribution, you will want to take note of the following contribution limit increases.

Note, that in 2025, employees ages 60 to 63 will be able to contribute an extra $11,250 to their retirement accounts, in addition to the standard contribution limit. This is an increase from the standard catch-up contribution of $7,500 for employees ages 50 to 59 or 64 and older. This change is known as the "super catch-up" and applies to 401(k), 403(b), and governmental 457(b) plans.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

The material has been gathered from sources believed to be reliable, however Bedel Financial Consulting, Inc. cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. To determine which investments or planning strategies may be appropriate for you, consult your financial advisor or other industry professional prior to investing or implementing a planning strategy. This article is not intended to provide investment, tax or legal advice, and nothing contained in these materials should be taken as such. Investment Advisory services are offered through Bedel Financial Consulting, Inc. Advisory services are only offered where Bedel Financial Consulting, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered unless a client agreement is in place.