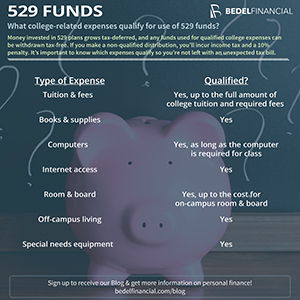

Do you know what post-high school educational expenses qualify for tax-free reimbursement from your child’s 529 account? It’s important to know what expenses do qualify in order to avoid paying taxes and a penalty for those expenses that don’t. You receive reimbursement tax-free from the account for a qualifying education expense. A non-qualified withdrawal requires payment of ordinary income taxes plus a 10 percent penalty tax on the earnings portion of the withdrawal. Your contributions are never taxed when withdrawn; only the earnings on those dollars are taxed and possibly subject to penalty.

Here are the answers to questions regarding some non-traditional college expenditures.

Q: Do expenses for studies at any post-high school educational facility qualify?

A: No. The school must be an accredited university, vocational school, community college or other accredited institution.

Q: What if my child lives off-campus?

A: Rent can be reimbursed up to the amount of the cost of a dorm at the university. Meal costs can be reimbursed up to the amount of a meal plan available through the school.

Q: Does the cost of airfare for a student studying abroad qualify for tax-free reimbursement? What about tuition, supplies, room and board?

A: Airfare is not reimbursable without penalty. Tuition, supplies, and room and board qualify; however, the penalty-free reimbursement amount is limited to the cost your child would incur at their school in the U.S.

Q: What if my child receives a scholarship?

A: An amount equal to that of the scholarship can be withdrawn from the 529 account without penalty. However, you will owe taxes on the earnings portion of your withdrawal.

Q: Can I use the 529 money to pay for my child’s involvement in sports or fraternal organization?

A: No. These expenses do not qualify for a tax-free withdrawal.

Q: What if I withdraw more from the 529 account than expenses incurred?

A: Roll the “overage” amount into a different 529 account within 60 days to avoid taxes. Keep in mind that you can only do one rollover per year. If you don’t catch it until after year-end, you’ll have to pay taxes and the penalty on the earnings portion of the overage.

Q: Can I claim the $2,500 American Opportunity Credit on my federal tax return and take reimbursement from my 529 account for all qualifying expenses?

A: No. You’ll need to reduce your 529 reimbursement by $4,000, which is the amount required to receive the full credit. If you don’t, you’ll owe taxes plus the 10 percent penalty on the earnings portion of the $4,000. No double-dipping!

If you’re unsure whether an expense qualifies for tax-free reimbursement, contact us for clarification. You can also reference IRS Publication 970 for a summary of qualifying expenses.

Recommended Articles

What To Do With a 529 Plan for a Disabled Child

With TCJA expiring on 12/31/2025, tax-free rollovers are...

Student Loan Repayment: Back Like Never Before

It’s not abnormal for borrowers to feel they are in a...