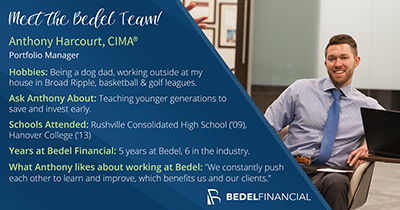

Anthony Harcourt, CIMA®

Portfolio Manager

As a Portfolio Manager, I focus on monitoring our clients’ investments and assisting in the research efforts for the Investment Committee. I also provide support to Portfolio Managers and internal teams regarding all facets of investment management and analysis, as well as assisting in client service and care.

Professional Investment Experience

- Over ten years of experience in investment management.

- Experience includes investment research and analysis, as well as the servicing of portfolios to help meet client goals.

Career History

- Bedel Financial Consulting, Inc., Portfolio Manager

- Bedel Financial Consulting, Inc., Investment Analyst

- Charles Schwab & Co., Inc., Investment Representative

- Bedel Financial Consulting, Inc., Investment Committee Intern

Education

- Bachelor of Liberal Arts, Economics, Hanover College

- Certified Investment Management Analyst®

BLOG POSTS

Financial Advice for New Parents

If you are already married and both working, you may have compared health insurance plans from both employers to see if joining the same plan makes sense. With a baby now in the picture, it is a good time to review and make sure you are on the best family insurance plan available.

1st Quarter Market Update

While we may not be able to rely on a 10%-per-quarter pace from equities, there is still much to celebrate in how far we've come from peak inflation in 2022 and the economy's strength in early 2024.

Fixed Income Portfolios: Go Long or Checkdown?

Over the last several months, the Bedel Financial team has taken small steps to lengthen the duration of our clients' fixed-income portfolios to lock in intermediate-term yields while remaining diversified on the shorter end of the curve.

Is The Recession Threat Over?

As we continue to monitor the inflation and economic data coming in, it is important to make sure your portfolio can withstand a bumpy ride should interest rates need to go higher than anticipated and tip the economy into a recession.

Looking to Move? Down Payment Funding

Many young adults face the challenge of moving from their "starter" home to the next home. Buying, selling, and moving between homes is no small task.

Trouble in Paradise: The FTX Collapse

If you've read our previous posts about crypto investing, you've already received cautionary advice about this new and unregulated asset class of cryptocurrency. However, the collapse could serve as a pruning that is helpful for the industry's long-term health.

IPOs & SPACs: Where did they go?

One of the fascinating developments during the COVID-19 pandemic was Wall Street's short-lived obsession with IPOs and SPACs. The recent choppy performance of IPOs is a good example of how quickly high-risk investments can decline in a broad market pullback.

Recent Graduates: Welcome to Financial “Adulting”

The important concept is establishing habits that will set you up for financial success moving forward. So let’s focus on some simple strategies that will help you get started on the right track.

Super Bowl Commercials: Crypto Paycheck?

Most vendors continue to require the U.S. dollar as a primary means of payment, and you generally can't use cryptocurrencies to pay for everyday expenses like rent, mortgage, food, and medical bills. As a result, Bitcoin is still best viewed as a speculative investment rather than a reliable way to receive your paychecks.

Why Holiday Gifts May Cost More

We may be in the middle of the largest supply chain disruption since World War II. But what is the "supply chain," and how did we get into this mess?

Are Stocks Expensive?

Investors need to consider the current environment when managing their return expectations in the coming years. If you are becoming concerned about higher valuations and fear a downturn, a strategy to consider is becoming more defensive with your equity allocations.

Are you a Gambler or Investor?

Investing in certain parts of the market without a plan can result in the same dynamic as gambling. Are you ready to make a bet?