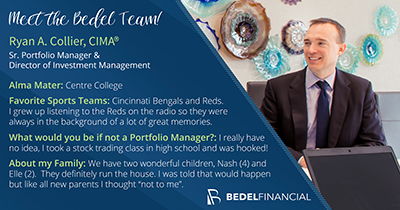

Ryan A. Collier, CIMA®

Vice President and Director of Investment Management

As Vice President and Director of Investment Management my focus is working with clients and trustees to ensure that their investment portfolio is invested appropriately based upon their goals and plans. As Director of Investment Management my role is to oversee the investment team to make sure that we are achieving our client's investment goals. Having been with the firm for over 15 years I feel the best part of my job is helping someone remove the worries or concerns they have about their investments.

Personal Financial Planning Experience

- Over 25 years of experience in financial services industry.

- Experience includes investment research and analysis, as well as, the developing and monitoring of portfolios to meet client goals.

Career History

- Bedel Financial Consulting, Inc., Sr. Portfolio Manager & Director of Investments.

- Wealth Management firm working with individuals and families to achieve financial security and lifetime goals.

- Fifth Third Bank , Investment Representative.

- Charles Schwab & Co., Investment Representative.

Educational and Professional Designations

- Bachelor of Liberal Arts, Economics, Centre College.

- Certified Investment Management Analyst®

Professional Activities & Accolades

- Recipient of Five Star Wealth Manager Award, Indianapolis Monthly - 3 Year Winner.

- Franklin Township Little League - Board Member and Treasurer (2021 - Present)

Column 1 Placeholder Content

BLOG POSTS

How to Gauge the Health of the Economy

We've covered nine economic indicators for examining an economy, though many more exist. Many are related, even if they appear in separate areas. Economists consistently debate which ones are more important when determining a country's current and future economic strength.

Considering an Annuity? Read this First

The annuity marketplace has evolved, and many modern annuities now offer reduced fees and greater transparency. Before purchasing, make sure you fully understand the costs involved.

Presidential Election and Your Portfolio

Many factors impact the return of the S&P 500. This would include wars, pandemics, and geopolitical circumstances that are not always in control of the president.

Where Are You Putting All That Cash?

With the Federal Reserve’s rapid interest rate increases, more options exist for your cash to earn interest. However, your bank may not be keeping up.

Investing in Uncertain Times

With markets at historically high valuations, rebalancing the risk in your portfolio may be prudent. However, as each investor’s situation and portfolio are different, it is best to talk with your financial advisor to determine if these investments should play a larger role in your portfolio.

Revisiting I-Bonds

Now that I-Bond yields are no longer offering the eye-watering yields of 2022, you may be looking to sell. Consider waiting until the November rates are revealed to see if the rates climb back a little higher and make the bonds more attractive versus other options.

Tax-Free-High-Yield College Savings

Only this year has the FDIC insured Savings Portfolio yield become attractive. Combining it with the tax-free potential and the state tax credit makes it a fantastic opportunity for those setting aside money for upcoming education expenses.

Tax Loss Harvesting – Be Careful

In December of each year, many mutual funds pay out capital gains. These payouts go to whoever owns the mutual fund on the "ex-dividend" date. These capital gains are gains incurred over the entire year. However, if you purchase the fund the day before the ex-dividend date, you will only own the fund for one day, but you will end up with the entire year's capital gain distribution.

What Investment Could Beat Owning an NFL Team?

Pat Bowlen purchased the Denver Broncos in 1984 for $78 million. Upon his passing in 2019, there were family disputes and court cases, which eventually resulted in the recent sale of the team for $4.65 billion.

Market Sell Off: Consider Tax-Loss Harvesting

Tax-loss harvesting can be one of the few benefits of a market selloff. However, you want to make sure you can use that benefit on your taxes, so knowing the wash-sale rule is important.

Self-Investors: Value or Growth?

Self-investors tend to select an asset allocation for their investment accounts and tend not to change anything as long as the performance is good. So what should you do?

Cryptocurrencies: What IRS Wants to Know

If you are a cryptocurrency fan, heads up! As cryptocurrency investing becomes more popular, the IRS will shine a larger spotlight on tax reporting.