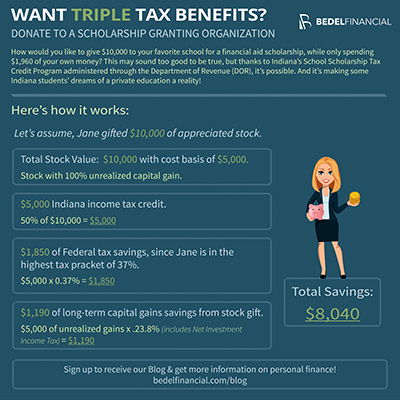

How would you like to give $10,000 to your favorite school for a financial aid scholarship, while spending less than $2,000 of your own money? This may sound too good to be true, but thanks to Indiana’s School Scholarship Tax Credit Program administered through the Department of Revenue (DOR), it’s possible. And it’s making some Indiana students’ dreams of a private education a reality!

Indiana’s School Scholarship Tax Credit Through SGOs

Indiana’s tax credit is available to individuals or corporations that donate to a scholarship-granting organization (SGO) approved by the Indiana Department of Education (DOE). Donors will be eligible to receive a 50 percent tax credit against their individual or corporate state tax liability.

These SGO scholarships are given to families who qualify for financial need based on an income threshold. So, the money is only going to families in need of financial assistance. Your donation may send someone to a private school who would otherwise never be able to afford it, while also helping to create greater diversity within our education system. Added bonus? As a proud alumnus of a qualifying educational institution, you can provide private school scholarships to deserving students!

Your Triple Tax Benefit

Under the current rule, not only do you receive a 50 percent Indiana state income tax credit, but you can also deduct the contribution amount, minus the state credit, on your federal tax return as a charitable deduction. But let’s take it one step further. Through the SGO program, you are allowed to gift appreciated stock, which creates a triple-threat tax savings strategy.

For example, let’s assume Ted gifted $10,000 of appreciated stock. Here’s how it works:

Total Stock Value: $10,000 with cost basis of $5,000.Stock with 100% unrealized capital gain$5,000 Indiana income tax credit

50% of $10,000 = $5,000$1,850 of Federal tax savings, since Ted is in the highest tax bracket of 37 percent

$5,000 x 0.37% = $1,850$1,190 in long-term capital gains savings from stock gift

$5,000 of unrealized gains x .23.8% (includes Net Investment Income Tax) = $1,190

Total Savings = $8,040

As you can see, a $10,000 gift to a qualified SGO, which will be used in funding financial aid scholarships for income eligible families, would ultimately cost Ted only $1,960.

Better Hurry to Take Advantage of This Triple Tax Break!

If you’re interested in benefiting from this gifting strategy, you need to be aware that the state of Indiana has allocated $15 million in total tax credits, with benefits available on a first-come-first-served basis. The state’s fiscal year runs from July 1, 2019, through June 30, 2020. To find a list of eligible institutions, gifting instructions, and more information about the program, please visit the Department of Revenue or view the list here: Indiana Department of Education.

Summary

Our Indiana legislators, along with the Department of Revenue and Department of Education, are doing a wonderful service by incentivizing Indiana tax payers with a 50 percent tax credit when they donate to eligible SGOs. The program supports students and families in financial need while financially rewarding donors. Indiana’s School Scholarship Tax Credit Program is a win-win for everyone!

About Us | More Articles | Get the Bedel Blog

Be sure to check out all of our info-graphics here!

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

Prior to implementing any investment strategy referenced in this article, either directly or indirectly, please discuss with your investment advisor to determine its applicability. Any corresponding discussion with a Bedel Financial Consulting, Inc. associate pertaining to this article does not serve as personalized investment advice and should not be considered as such.