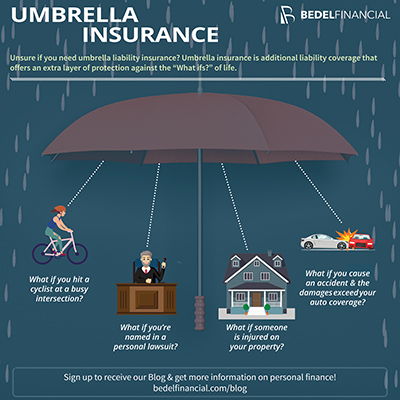

If a visitor falls at your home or an accident occurs with your car resulting in serious damages, will your insurance cover all the costs? It depends. Your homeowner and auto policies provide for liability coverage. But if it isn’t enough, you may be stuck.

Have you considered the importance of obtaining umbrella liability insurance? Many times, umbrella coverage is overlooked. Unlike homeowner, auto, and health insurance, umbrella policies are not required by law or by lenders. However, this does not make umbrella liability coverage any less important. And the best part – umbrella coverage is cost-effective and relatively inexpensive!

What is Umbrella Liability Insurance?

Umbrella liability insurance is an extension of homeowner, renter, and auto insurance liability coverage that protects your assets from major claims and lawsuits. Once limits have been reached on your underlying liability coverage, an umbrella policy provides additional protection to safeguard your assets. Important to remember: Without an umbrella policy, the costs incurred after your homeowner, renter, or auto policies are depleted must be paid out of your pocket.Bodily injury and property damage are the two main hazards that umbrella liability coverage protects against. As an example, once your homeowner liability limits have been exhausted, an umbrella policy would cover medical bills of an individual who sustained an injury due to your dog biting him or her. Or, if you were at fault in a car accident and your auto policy liability coverage was not sufficient to pay all the repairs on the other person’s vehicle, the umbrella policy would pick up the costs up to its limits. If you are a landlord, an umbrella policy will provide the same types of coverage for your rental units.

In addition to bodily injury and property damage, umbrella liability insurance may pay for lawsuits as well as attorney and other legal expenses not covered by your homeowner, renter, or auto policy. However, personal umbrella insurance does not cover liabilities that are in conjunction with business activities, business property, or professional services.

Who Needs It?

The real question is who doesn’t need umbrella liability insurance. Anyone who earns income and owns assets is an ideal candidate for this type of coverage. It is a low-cost way to protect assets from being liquidated to pay for damages to others and disastrous lawsuits that could happen to anyone, not just individuals with large amounts of wealth.Umbrella insurance protects you, the insured, as well as any resident relatives of your household. It not only protects you in the United States, but it protects you from liability anywhere in the world. For example, if your child was studying abroad and was at fault for causing an auto accident, your umbrella liability policy would provide coverage.

How Much Do You Need?

Determining the amount of umbrella liability coverage depends on a variety of factors including: net worth, profession, geographical location, and hobbies. As an example, if you are in a profession with high public exposure, you may have a higher likelihood of having a lawsuit brought against you. Or, if you are someone who enjoys competitive dirt biking, you may face more risk than someone who enjoys bike riding on local trails. Since umbrella coverage begins when homeowner, renter, and auto policies are exhausted, there are certain limits that must be met by an umbrella policy. For example, if your homeowner’s liability coverage limit is $500,000, then your umbrella coverage must begin at $500,000. Any gap in coverage would cause you to have personal exposure. Generally, insurers will coordinate umbrella policy limits with your other policy limits to ensure gaps do not occur.

Typically, umbrella insurance policies provide $1 million to $2 million in additional coverage for an average cost of $380 per year. This may seem like a lot, but approximately 13% of personal injury liability awards and settlements are $1 million or more, according to industry specialists.

As a preliminary guideline, you should consider umbrella coverage to match the value of your assets. Current and anticipated income should be a factor as well. If held responsible in a lawsuit, your payment for damages could be based on current net worth as well as your future earnings. It is important to reassess your coverage every few years to adjust as appropriate.

Summary

Protecting you and your family from potential devastating liability and lawsuits is key. An umbrella policy can provide peace of mind with a low price tag. For more information, talk with your financial advisor or insurance professional.Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

Recommended Articles

COBRA or Marketplace Health Insurance – What’s the Difference?

Is one better than the other? Which one is right for you...