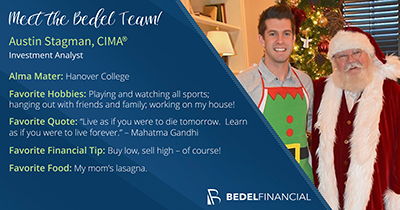

Austin Stagman, CIMA®

Portfolio Manager

As a Portfolio Manager, I work to construct and maintain each client’s investment portfolio to ensure it is aligned with their specific short- and long-term financial goals. As a member of the Investment Committee, I regularly monitor investment vehicles and explore new investment opportunities.

Professional Investment Experience

- About eight years of experience in the financial services industry

- Experience includes active trading for clients such as advanced options trading, high dollar trades, penny stocks, fixed income, etc.

- Servicing trade disputes and trade related issues.

- Having in depth conversations with clients to help them learn and understand the financial industry.

- Investment research and due diligence

- Portfolio construction and maintenance

Career History

- Bedel Financial Consulting, Inc., Portfolio Manager

- Bedel Financial Consulting, Inc., Investment Analyst

- Charles Schwab & Co., Inc., Affluent Client Professional

- Charles Schwab & Co., Inc., Investment Representative

- C.H. Robinson Worldwide, Inc., Transportation Sales Representative

Education

- Bachelor of Liberal Arts, Economics, Hanover College

- Certified Investment Management Analyst®

BLOG POSTS

Why is Gas so Expensive?!

The oil and gas market is a complex global market impacted by many factors. Unknown variables (both economic and political) are sure to play a role in pricing, and economists continuously debate their relative importance.

The Fed Tapering: What Does It Mean?

The rate at which the Federal Reserve has been purchasing assets is more than we have ever experienced. What signals does that send to investors, and how does the stock market react when the Fed buys or sells assets?

Tough Time to Find Used Cars: Indiana has Best Value

Used vehicle price increases are frustrating to consumers who need a vehicle now. However, remember the negotiating power you hold for those who already have a used vehicle to trade-in/sell.

Inflation’s Impact on Your Portfolio

Inflation is a complicated topic that economists have debated for centuries. While the Federal Reserve has indicated that it will begin to increase interest rates, if necessary, to combat high inflation, its ability to do so without negatively impacting the stock market is unclear.

Tales from the Crypt-o

The BItcoin hype is back, but it is important to keep in mind that most of the companies investing in Bitcoin are doing so in very small amounts.

Hedge Funds: Risky Investment or Portfolio Diversifier?

You must do your research before investing in a hedge fund. You will want to be familiar with the investment strategy and understand the fee structure as well as their liquidation rules.

Dow Jones: 30,000 Points?

Investing will always be met with uncertainty, whether the Dow is 20,000 points, 30,000 points, or 40,000 points. It is rarely a smooth ride to that next milestone.

Let’s Split the Apple!

Apple (APPL) is one of the largest publicly traded companies and has a market cap that recently surpassed $2 trillion! So why are they splitting their stock, and how will it impact your portfolio?

Buying/Selling Your House: What’s the Coronavirus Impact?

The COVID-19 pandemic has affected all aspects of the economy. But what impact has it had on the residential real estate market? Are fewer homes being sold? Are prices declining? Some of the results might surprise you.

Tax Time! IRA Basics and Surprising Facts

As tax season nears, people of all ages have questions about IRAs. They may seem pretty straight-forward on the surface, but how much do you know about them? Let’s refresh your memory of IRA basics and explore some surprising facts.

5 Things to Know Before You Open a Roth IRA

Saving for retirement outside of a company-sponsored retirement plan—such as a 401(k)—might be easier than you think. But before you go and open a Roth IRA, there are some things that you will want to know.

Demystifying Economic Indicators

Are you hearing chatter about an upcoming economic recession? Economists use a variety of economic data to formulate their opinions but they are often confusing and meaningless to everyone else. Here are some of the more common economic indicator data points and their significance.