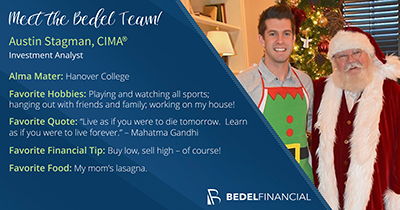

Austin Stagman, CIMA®

Portfolio Manager

As a Portfolio Manager, I work to construct and maintain each client’s investment portfolio to ensure it is aligned with their specific short- and long-term financial goals. As a member of the Investment Committee, I regularly monitor investment vehicles and explore new investment opportunities.

Professional Investment Experience

- About eight years of experience in the financial services industry

- Experience includes active trading for clients such as advanced options trading, high dollar trades, penny stocks, fixed income, etc.

- Servicing trade disputes and trade related issues.

- Having in depth conversations with clients to help them learn and understand the financial industry.

- Investment research and due diligence

- Portfolio construction and maintenance

Career History

- Bedel Financial Consulting, Inc., Portfolio Manager

- Bedel Financial Consulting, Inc., Investment Analyst

- Charles Schwab & Co., Inc., Affluent Client Professional

- Charles Schwab & Co., Inc., Investment Representative

- C.H. Robinson Worldwide, Inc., Transportation Sales Representative

Education

- Bachelor of Liberal Arts, Economics, Hanover College

- Certified Investment Management Analyst®

BLOG POSTS

Strong versus Weak Dollar - Which Is Better?

Currency exchange rates around the globe are always fluctuating, including our U.S. dollar. Right now the U.S. dollar is “strong.” That’s a good thing for your wallet and the economy, right? Not necessarily. Economists can make a valid argument either way. Take a look at what determines the strength of a currency and the impact it can have.

Investing in HSA’s

Investing in a Health Savings Account (HSA) can be a great way to potentially achieve long-term tax-free growth on your money. If your company’s HSA has an investment component to it, it’s important to ensure that the investments you’re choosing match your risk tolerance. To find out more, read on.

SECURE Act: Retirement Changes Are on the Horizon

Retirement changes are on the horizon with the House’s passing of the SECURE (Setting Every Community Up for Retirement Enhancement) Act. The act is designed to encourage saving for retirement and promote long-term financial stability. Read on to see how the proposed changes might affect your retirement planning, and when the bill could go into effect if it passes the Senate.

Credit Card Balance Transfers: Worth the Hassle?

Credit card balance transfers can be a useful tool in paying down credit card debt more quickly and with less money owed. But there’s more to it than just that. It’s important to understand if a balance transfer works with your unique financial plan. We’ve explored the details to help you make a smart decision.

Target-Date Funds: Are They Right for You?

Chances are you’ve heard of target-date funds…but do you really know what they are and if they’re a good fit for your investment plan? We dive into the particulars so you don’t have to! Read on for more information on the pros of target-date funds, as well as their downside.

An Antidote for First-Time Homebuyer Jitters

Buying a home for the first time can be an overwhelming process, but there are things you can do to help you through it. We walk you through the steps, from how to prepare yourself financially to what the purchase process typically looks like. When you’re ready to purchase your first home, be sure to take our tips into consideration – they just might help you be successful in your home-buying adventure!

Stock Market Volatility: How to Survive

It’s been just over a year since the Dow Jones reached 20,000 points. Since then, we’ve had a pretty easy ride without too much market volatility…until February. While it’s nearly impossible to predict the Dow Jones future, you can educate yourself on why there’s volatility in the market, as well as the best course of action to take when volatility strikes.

Investing with the New Tax Plan

Wondering how future investing and tax strategies might be impacted by changes outlined in the Tax Cuts and Jobs Act? What’s changed and what’s stayed the same? We have you covered - we’ve compiled a list of those changes that might be most pertinent to you, as you consider your investment and tax strategies.

Keep Fraudsters at Bay by Freezing Your Credit

Keeping your credit secure is more difficult than ever. Perhaps the safest course of action is to freeze your credit. Here’s what you need to know.

Equifax Victim? Now What?

Are you a victim of the Equifax hack? Here’s what happened and what you should do if your information was compromised.

Directly Held Stock Versus a Brokerage Account: Questions & Answers

Do you receive mail from a company that holds shares of only one specific stock on your behalf and don’t know what to do with it? Most likely ...

Dow Jones 20,000: Time to Sell?

Dow hits record high 20,000! Can it go higher? Will the bottom drop out? Should you buy, sell, or hold? These are all good questions with no easy ...