Balancing Family Priorities

The Balancing Act: Managing Multiple Financial Commitments

Balance is what your 40s are all about - finding a balance between living your life and preparing for retirement. Weighing the rising costs of your lifestyle (bigger house, car for your teen, college costs, etc.) with the increasing pressure of saving for retirement. Learning to balance personal and family financial commitments.

If you're raising children and also taking care of your parents, you are part of the sandwich generation. It's easy to see how balancing all of this and caring for multiple generations can put a financial burden on families.

The Pew Research Center recently noted that, on average, 48% of adults are providing some form of financial support to their grown children, while 25% are financially supporting their parents as well.

Unsure if you're finding the right balance?

Contact Us

Providing for Your Kids

We all know raising kids is expensive.

College can be financially burdensome for so many families.

The cost of higher education has surged more than 538% since 1985, and it doesn’t appear those escalating costs are slowing anytime soon.

So, what do you do? Rely solely on student loans? Do you hope that higher education is offered for free in the future? Pray your child lands a scholarship? Sure those are options, but there are more prudent alternatives to this potential dilemma.

To combat education inflation, you have to invest your college funds. There are several places to invest your money; however, 529 Plans have risen in popularity due to the tax advantages they hold over other choices. Start by checking for tax benefits provided through your state-sponsored plan.

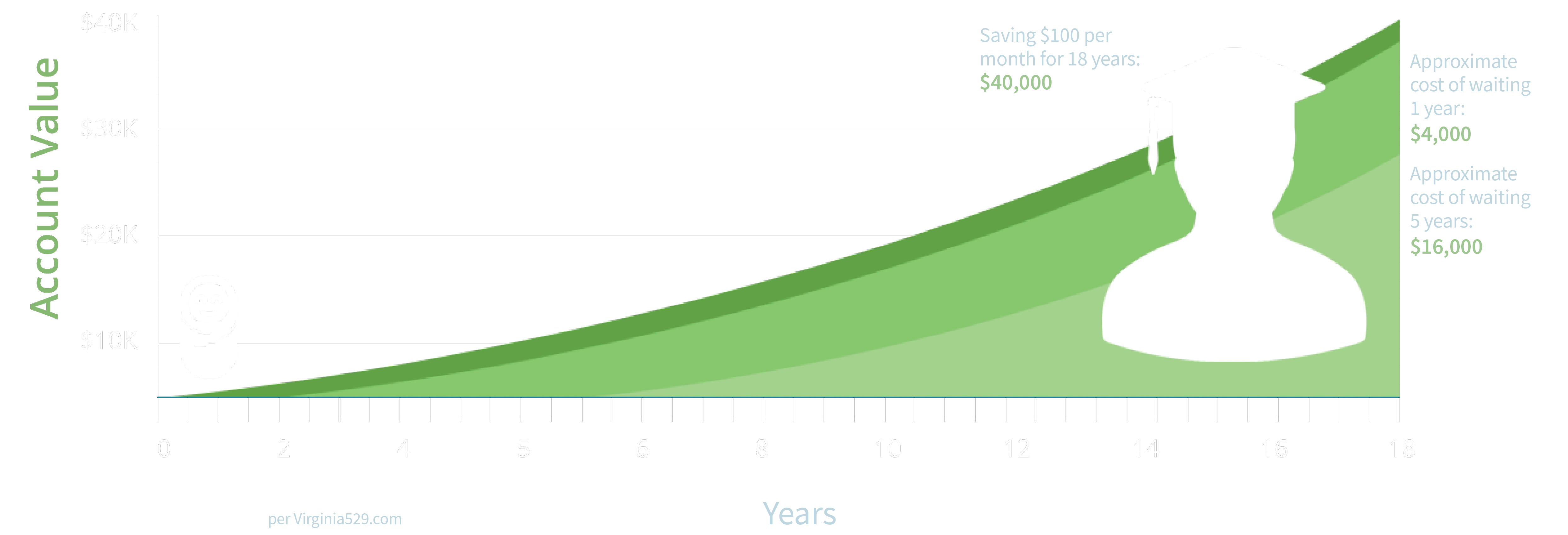

Depending on the age of your child, you could have up to 18 years to save for their college expenses. The earlier you start, the greater the impact compounding interest will have on your savings.

For example, if you begin saving just $100/month from the time your child is born until they go off to college, your 529 account will grow to nearly $40,000* by the time they step on campus.

While that may not cover their entire tenure at the university, it will certainly help offset some of the need for student loans. So, save early and save often! *Assumes a 6.25% annual growth rate.

“The power of compound interest is the most powerful force in the universe."

--Albert Einstein

529 Benefits

- Investments grow tax-deferred

- Account owner retains control of the account

- Qualifying expense withdrawals (tuition, room & board, books) are taken tax-free

- No income or age restrictions

- For Indiana residents, taxpayers are eligible for a 20% state tax credit for each dollar contributed (up to $1,000 annually) Read More: 529 College Savings Accounts - Does This Expense Qualify?

- Possible use of up to $10,000 annually for K-12 private school education

**For more information, visit our 529 Plan Resource Page and the Saving For College website

Discussing Finances with Family

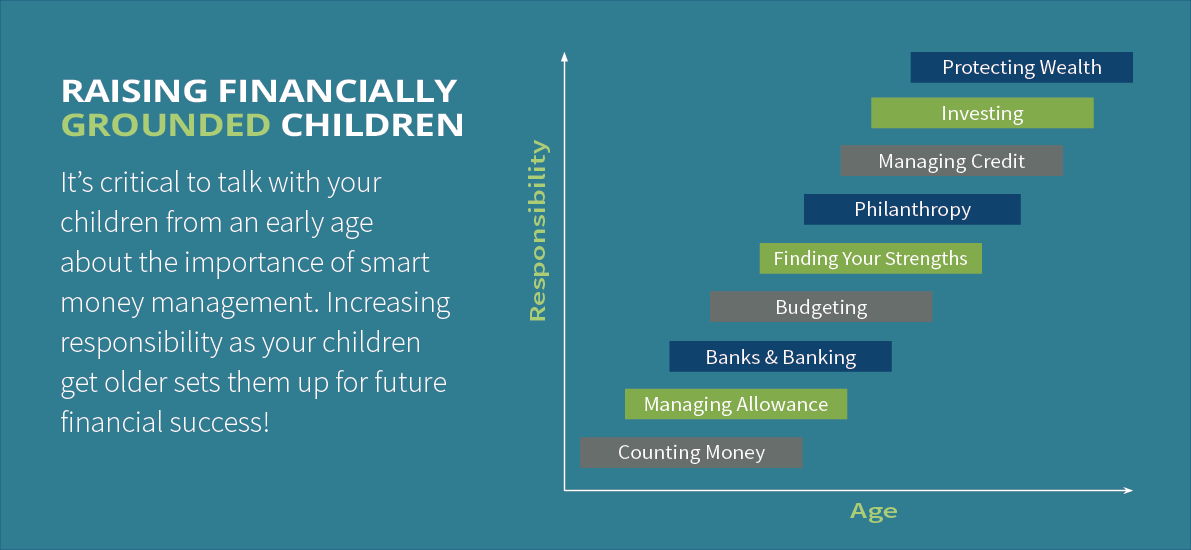

While we’re on the subject of education, it’s important to focus for a moment on teaching your children financial literacy.

There are three important lessons in money management that you should discuss with your young children:

As they get older, children continue to build on these principles and learn how to budget; manage debt, such as credit cars, car loans and buying a home; and save for their own retirement.

Family Wealth Transitions

Gifting

If you want to save for your child’s college education or help them with a down payment on a home, you have the ability to gift $15,000 per person per year without having to file a gift tax return. For example, if you are contributing to a 529 Plan, one parent can gift $15,000, and the other parent can gift $15,000 for a total contribution of $30,000.

Loans

Perhaps you would like to loan money to your children to purchase a home. In this case, it is important that you formally document the loan. Create a promissory note that indicates the amount and the terms of the loan. The terms should include the length of the loan, the interest rate being charged, and the payment frequency. The Internal Revenue Service (IRS) provides guidance regarding the minimum interest rate (Applicable Federal Rate (AFR)) that must be charged to avoid the recognition of a gift between the lender and the borrower.

Equality

What if you’ve gifted money to one child but not to the other, and you want to make sure all is equal? You can gift the other child the same amount of money, but many parents elect to equalize everything in their will or revocable trust. For example, if you gifted a child $60,000 for a down payment on a home, he/she receives $60,000 less in inheritance.

Read More: Should You Ever Lend Money to Family?

Family Meetings

All of the above gifting and lending strategies work in "reverse" if you are helping your aging parents. In many instances, the sandwich generation is assisting their aging parents move from their home to a continuing care community, and there can be concern whether the financial resources are substantial enough to support their care. Conversations should also be centered around their estate plan:

- Does the will and/or living trust distribute assets according to their current wishes?

- Are the beneficiary designations on retirement accounts, life annuities and annuities appropriate?

- Do they have the correct people named as financial and health care power of attorney?

Family meetings allow all parties to come together and discuss pertinent financial details.

Not every financial detail needs to be discussed during a family meeting. Instead, it’s more critical to convey last wishes, stewardship of inheritance, and location of important documents. Once everyone is on the same page, you’ll be better prepared should something happen. Read More: Family Talk & Time to Make Your Family’s Financial Game Plan?

At Bedel, multi-generational planning is at the heart of what we do. Many of our clients would like to leave a lasting legacy. We work with these families to not only pass their wealth onto future generations in the most efficient way possible but also to ensure that any heirs have financial stability and a foundation for success.

According to the Institute on Aging (IoA), the average caregiver falls within the following criteria:

- Female (75% of caregivers)

- 46 years old

- Married

- Works outside the home

- Earns $35,000 annually

Having a discussion with your parents regarding their financial security is essential. Do they want to remain in their current home? Are they interested in a retirement living community? Do they have long-term care to assist with their health or personal care needs? As humans, we often act impulsively with our hearts while ignoring logic. When it comes to our loved ones, proper judgment and reasoning often go out the window. As Peggy Speers conveyed in her book “The Inspired Caregiver,” "I love you, but I got to love me more." It's vital that you consider all the potential ramifications of caring for a parent, as admirable as it may seem.

Read More About Caring for Aging Parents:

When Parents Depend on You

Your Aging Parent is Ill - Now What?

Role Reversal: Becoming a Legal Guardian for Elderly Parents