Sub-heading

Info about the page.

Test video - info here.

Single article embedded with module. Test

Important 529 Plan Changes

Any Indiana resident contributing to a CollegeChoice 529 plan is eligible for a refundable state tax credit. Being an account owner of a CollegeChoice 529 plan is not a requirement to receive the credit.

Grandparent Owned 529 Plans: What You Need to Know

Helping a grandchild with their college expenses by putting money in their 529 is great! But do you know if contributions count as a gift or if the grandchild is a "skip person," or if it can hurt financial aid eligibility?

What To Do With a 529 Plan for a Disabled Child

With TCJA expiring on 12/31/2025, tax-free rollovers are also set to expire. There is, however, a bill called the ENABLE Act that would make tax-free rollovers permanent. The ENABLE Act becoming law seems promising, as it passed the United States Senate in September 2024.

New 529 Plan Changes

The Tax Cuts and Jobs Act bill has many Americans wondering just how they’ll be affected by the first major tax overhaul in nearly thirty years. If you own a 529 account, you’ll want to be sure to stay abreast of the changes to your plan in order to take full advantage of any new benefits that are coming. We’ve highlighted the main changes to 529 plans and how they might impact your education savings!

What You Need to Know to Save For College and Save On College

The cost of attending college continues to rise and there is little we can do to alter this trend. If you are planning to assist with education costs for your children, you'll not only have to start saving earlier but you'll have to save smarter as well. “Education Funding” covers the pros and cons of the most popular savings vehicles. It also provides information on funding sources and gives you some financial strategies that can help your education funds go further.

this is our ebook - so we can add from the Resources page if there's anything there as well.

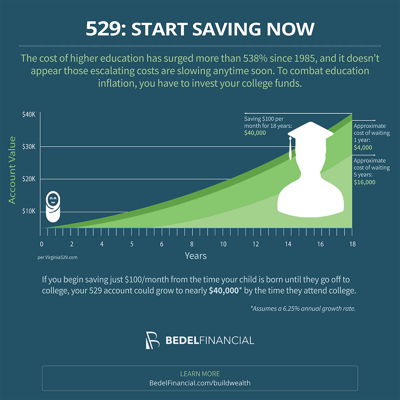

Putting as little as $100/month into a child's 529 could help you afford the surging cost of higher education.

Learn more in the Family Financial Planning chapter of our How To Build Wealth in Your 40s series.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.