Sub-heading

Info about the page.

Test video - info here.

Single article embedded with module. Test

529 Plans & Tax Time

Some (not all) contributions to your 529 account need to be reported on your tax return, along with some (not all) distributions made from your 529. That's not confusing at all, right?

Kate’s 2019 Holiday Gifting Ideas

Unsure of what to get your nieces and nephews, brothers and sisters for the holidays? Teaching your loved one about the power of investing and compounding interest could lead to big rewards in their future.

529 Plan: Owner & Beneficiary Strategies

The SECURE Act 2.0 was signed into law on December 29, 2022. While this bill has many provisions, one that has gained a lot of attention is the 529 Plan to Roth IRA Transfer starting in 2024. Keep in mind that a few conditions must be met for this transfer to occur.

What You Need to Know to Save For College and Save On College

The cost of attending college continues to rise and there is little we can do to alter this trend. If you are planning to assist with education costs for your children, you'll not only have to start saving earlier but you'll have to save smarter as well. “Education Funding” covers the pros and cons of the most popular savings vehicles. It also provides information on funding sources and gives you some financial strategies that can help your education funds go further.

this is our ebook - so we can add from the Resources page if there's anything there as well.

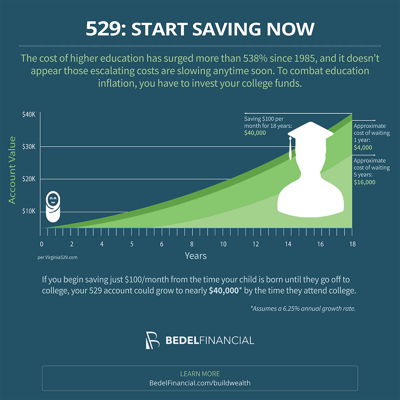

Putting as little as $100/month into a child's 529 could help you afford the surging cost of higher education.

Learn more in the Family Financial Planning chapter of our How To Build Wealth in Your 40s series.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.