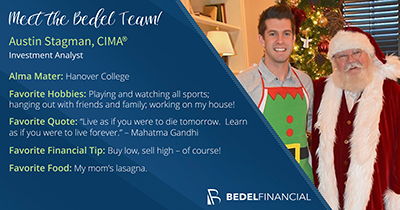

Austin Stagman, CIMA®

Portfolio Manager

As a Portfolio Manager, I work to construct and maintain each client’s investment portfolio to ensure it is aligned with their specific short- and long-term financial goals. As a member of the Investment Committee, I regularly monitor investment vehicles and explore new investment opportunities.

Professional Investment Experience

- About eight years of experience in the financial services industry

- Experience includes active trading for clients such as advanced options trading, high dollar trades, penny stocks, fixed income, etc.

- Servicing trade disputes and trade related issues.

- Having in depth conversations with clients to help them learn and understand the financial industry.

- Investment research and due diligence

- Portfolio construction and maintenance

Career History

- Bedel Financial Consulting, Inc., Portfolio Manager

- Bedel Financial Consulting, Inc., Investment Analyst

- Charles Schwab & Co., Inc., Affluent Client Professional

- Charles Schwab & Co., Inc., Investment Representative

- C.H. Robinson Worldwide, Inc., Transportation Sales Representative

Education

- Bachelor of Liberal Arts, Economics, Hanover College

- Certified Investment Management Analyst®

BLOG POSTS

Travel Insurance – May be Worth it!

According to Bloomberg, the average spring break trip now costs more than $8,000. This is about double what you would have paid in 2019. With these increased upfront costs, what if something happens and you can’t go? As you now turn your attention to summer travel plans, it may be worth exploring travel insurance.

Traditional vs. Roth IRAs

Between now and April 15th, millions of taxpayers can make a 2024 or 2025 IRA contribution. Understanding the nuances of Traditional and Roth IRAs can potentially lead to tax savings.

The Current Car Market: New vs. Used

The low supply of used cars means that incentives are hard to come by, as dealers are in no hurry to get rid of product.

What is a Target-Date Fund?

Whether or not you invest in a target date fund will most likely depend on how much control you want over your overall allocation.

Bitcoin ETFs: Do They Have a Place in Your Portfolio?

It's important to note that a handful of Bitcoin ETFs were trading before the SEC's decision. However, those funds utilized Bitcoin futures contracts rather than Bitcoin itself.

Equity Compensation: The Benefits and Dangers

Although everyone's financial situation is different, it's typically beneficial for an employee to participate in these programs—especially if you are optimistic about the future growth of your company.

Retirement Plan Considerations when Changing Jobs

Each company’s plan will differ from others. It’s important to talk with a financial advisor to help advise what the best option is, how much to contribute, and what investments you should use.

How Strong is the U.S. Consumer?

In an ideal world, the consumer steadily spends money with zero credit card debt and a healthy savings balance. However, we live in the real world. Given the circumstances, the U.S. consumer is still in relatively good shape.

Inflation Hedge in 2022: Bitcoin vs. Gold

Bitcoin is a very new investment, first introduced in 2009, so it may need more time to adapt. Gold has been around for thousands of years. Periods of high inflation will typically create volatility in markets.

Used Car Prices Finally Starting to Cool Off

If you are in the market for a used vehicle, you should feel relieved that prices are starting to cool. It's also good news that Hurricane Ian should only slightly impact the market and for a short period.

Point of Interest (Rates)

Interest rates are on the rise! What does this mean for your money? Well, it could be good or bad news depending upon where you keep your cash holdings. We’ve outlined how rising interest rates could affect your loan rates, credit card rates, investment returns, and more. Read on to ensure you’re getting the most yield from your cash holdings while those rates continue to rise.

Is There Relief in Sight for Housing Prices?

How things play out will depend on the future supply of existing and new homes for sale, the health of the mortgage market, and the consumer's financial well-being. If you are looking to sell your home, you might want to do so sooner rather than later.